Background and objectives

At a French private non-profit foundation, we helped to diagnose compliance with the law on electronic invoicing for all flows linked to customer and supplier invoices, in a particular context of implementation of a new S2C tool.

Our approach is based on :

- review of existing processes (business/IT/referential)

- projection of target processes with COUPA, the tool currently being implemented to optimize and anticipate target diagnostics

- impact study on IT tools and environment, on OTC and S2P perimeters

- proposing scenarios for compliance with the Finance Act, adapted to the specific features of the business

Our mission

Analysis of the impact of the new obligations by type of flow in terms of organization, processes and tools, and identification of compliance needs.

Identification of missing / incomplete data vs. obligations (new invoice mentions, new data to be reported on invoices, new invoice processing / collection statuses, etc.).

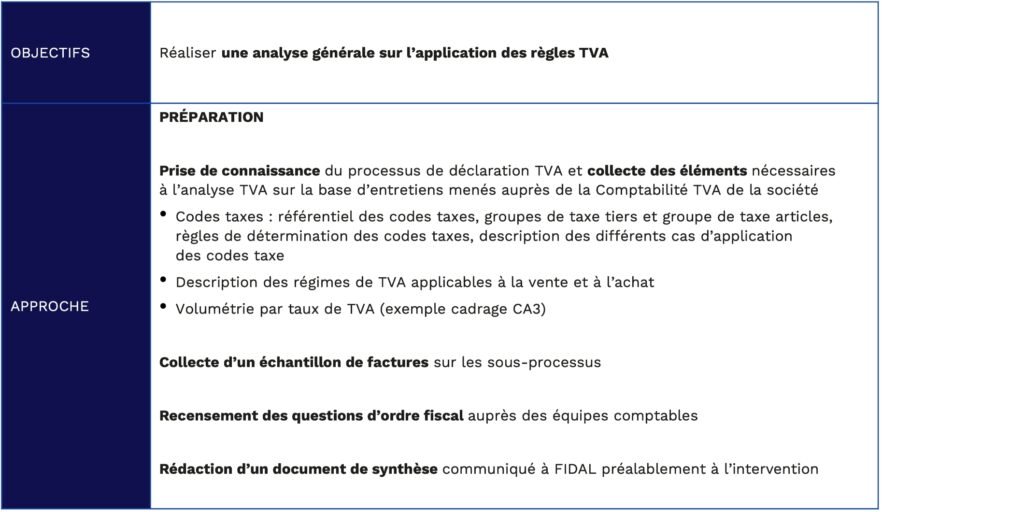

Analysis, with our partner FIDAL, of the structure’s specific VAT characteristics: eligibility of particular activities for the reform, measurement of the reform’s impact on VAT sectorization.

Recommendations on the organization of future S2P & O2C processes, studying opportunities to standardize and improve them.

Recommendations for upgrading current tools (interfaces to be developed) and repositories (which master repository, what information to add where and from which sources, etc.).

Studies and recommendations on the various possible scenarios: PDP vs PPF vs OD and possible evolutions of the chosen S2C tool in terms of complexity, benefits, project/run costs, etc.

Identification of functional and technical requirements and drafting of specifications to meet the new obligations

Results

Project framing, planning, governance, awareness-raising/training and change management strategy adapted to the various players involved in the project (end-users – scientists, finance department, purchasing department, internal control, IT department, etc.).

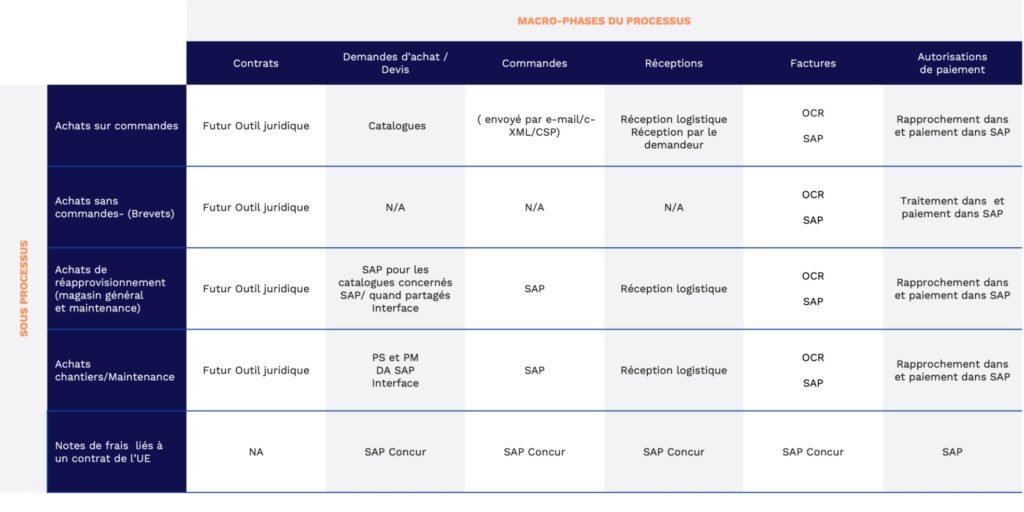

Analysis of figures, flow mapping and review of potentially impacted processes from 2 angles:

- Business

- IT/interfaces

Proposal of recommendations, co-construction of a target organization and a roadmap, integrating the various compliance projects to be investigated by major theme.

Identification of in-depth analysis actions to be carried out on VAT processing and CA3 input (contacts with certain suppliers/customers, secondary establishments, ….).

Construction of specifications through review and validation workshops with business units and the IT department

Objectives and work carried out